With cryptocurrency prices and trading volumes booming, cryptocurrency exchanges are seeing a meteoric rise in business. At the same time, exchanges, which are largely unregulated, remain an apparent weak point in the cryptocurrency ecosystem: high-profile thefts of client holdings by hackers still seem to occur on a regular basis at exchanges around the world.

New Money Review founding editor Paul Amery asked Obi Nwosu, chief executive of Coinfloor, a group of cryptocurrency exchanges, how he sees the exchange business evolving, how his firm handles the security of client assets and how he views the long-term prospects for the cryptocurrency market.

[Disclosure—Paul has an account at Coinfloor]

New Money Review: Obi, what trends in trading volumes has Coinfloor been seeing?

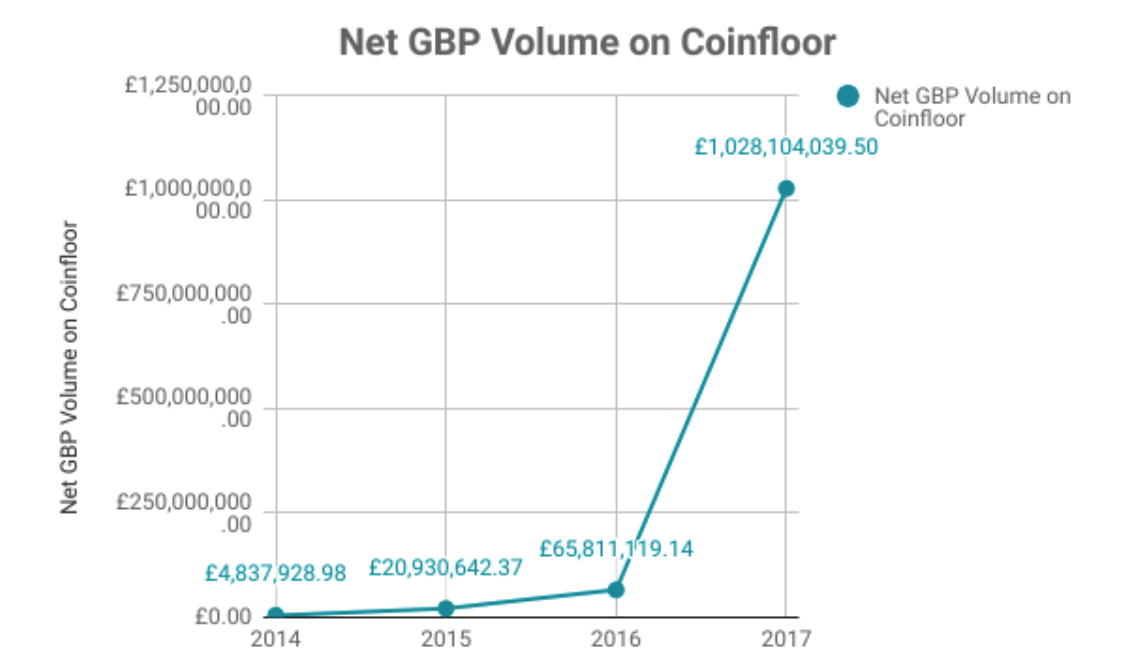

Obi Nwosu: We saw over £1 billion in net trading volumes during 2017, an increase of over 1500% on the year before. In bitcoin terms, our trading volumes were up 115% year-on-year.

Coinfloor trading volumes

Coinfloor trading volumes

Bitcoin (XBT) to sterling trades represent around 90% of the total and Bitcoin Cash (BCH) to sterling trades the remainder.

So far our exchanges offer trading only in these two cryptocurrencies. We’re looking to add other currencies soon, but we’ve taken quite a conservative stance to date: we want to make sure we’re comfortable with the mechanisms of storing the relevant currency securely. Our policy is to keep 100% of client balances in multi-signature cold storage. That means it takes more effort to onboard a new currency.

New Money Review: Among cryptocurrency exchanges, there’s a great variety of business models, including crypto-to-fiat, crypto-to-crypto, centralised and decentralised. How do you see the exchange business evolving and consolidating?

Obi Nwosu: We like to think of cryptocurrency exchanges as falling into four main categories.

Obi Nwosu

First, some exchanges act as the main regional on- and off-ramps between fiat currencies and cryptocurrencies. Historically, we’ve done this for a sterling client base, although we’re now looking to expand regionally.

Other exchanges focus on crypto-to-crypto trading, with a more global client base. Trading crypto-to-crypto means they don’t have to deal to the same extent with the complexities of operational security, such as compliance with know-your-customer (“KYC”) and anti-money laundering (“AML”) rules.

The third category is decentralised exchanges. These will also necessarily be crypto-to-crypto, but will be powered by a smart contracting platform, rather than operating via a single order book. I expect decentralised exchanges to become faster and easier to use.

Finally, there will be internationally focused, fiat-to-crypto exchanges that act as the backbone of global cryptocurrency liquidity. These may also allow shorting and trading in leveraged products, since these activities also help generate liquidity.

New Money Review: How can Coinfloor customers short bitcoin if they want to do so?

Obi Nwosu: They would have to use an alternative trading tool, such as futures or spread betting. Currently Coinfloor doesn’t offer a mechanism to go short, since shorting involves the use of leverage—i.e., selling what you don’t own. Up to now, we’ve wanted to focus on security and reliability in our business model, and on 100% backing for client balances.

Having said that, it’s something we and a lot of others are looking at and that a lot of clients ask us about. For the client base we target—institutions and sophisticated traders—it would be a natural progression in terms of the service offered.

[Editor’s note: After this interview took place, Coinfloor announced it was introducing a bitcoin futures exchange via a separate subsidiary called CoinfloorEX]

New Money Review: So you would have to give up your 100% cold storage model?

Obi Nwosu: If we wanted to allow shorting, yes, we would have to separate client accounts into two different buckets. In one, client balances would be fully backed by coins in cold storage. In the other, we would allow trading with leverage.

New Money Review: Security (or the lack of it) at some cryptocurrency exchanges is a constant concern for investors. Have you changed your practices over time?

Obi Nwosu: We haven’t changed our practices at all. Before we even started, we were very focused on security. Our base assumption is that if you have cryptocurrency on an internet-connected device—in other words, you store the private keys that allow you to sign a transaction on such a device—then at some point you will be hacked.

As far as I’m aware, there hasn’t yet been a case of balances held offline at exchanges being stolen—it’s always been so-called hot wallets that have been compromised.

“Over time, banks are getting more comfortable with the idea of accepting cryptocurrency companies as clients.”

New Money Review: Isn’t there a point in the day at which my coins, if sent to you to be sold, are in hot storage?

Obi Nwosu: No. At Coinfloor, clients deposit coins directly into cold storage at the exchange. Currently, we provide company-owned bitcoins to fund our advance withdrawals service, allowing users to withdraw up to 2 bitcoins without waiting for a cold storage withdrawal.

But withdrawals of over 2 bitcoins take place up to 3 times a day during business hours. We believe that this slower withdrawal speed is worth the peace of mind that comes from knowing no client funds are ever accessible in a hot or warm wallet.

Other exchanges might keep a float of coins in hot storage and only make transfers to and from cold storage once a week or once a month—particularly if client inflows and outflows are more or less balanced in aggregate.

New Money Review: You don’t charge separately for custody. Given you make a business case for extra security in custody, wouldn’t it make sense to do so?

Obi Nwosu: We are often asked this. At some point, custody may become a paid-for service. But up to now we’ve felt it was better to focus on generating revenue from trading fees.

New Money Review: Who, if anyone, regulates the amount of capital you have to hold as an exchange?

Obi Nwosu: Right now, no one. But even before we launched we approached the Financial Conduct Authority, the UK’s securities market regulator, to explain what we were planning to do, with a view to being regulated. At the time the FCA decided they weren’t ready to regulate us, but we’ve since been in regular contact with them and other policy advisors.

Last year, we published a white paper with consultancy firm Protiviti, entitled “Bitcoin: the Path to Regulation”, to map out how we see this occurring.

New Money Review: Many cryptocurrency companies have complained about the difficulty in obtaining support from banks. There have also been many past reports of banks arbitrarily closing the accounts of cryptocurrency traders. What is your experience of dealing with banks? Which banks service Coinfloor?

Obi Nwosu: We work with a number of EU-based banks, who handle payments in fiat currencies for us and our clients. We have regular conversations with UK banks and I think, as time has gone by, they are getting more comfortable with the idea of accepting cryptocurrency companies as clients.

We’ve made a promise of servicing a particular type of client and we’ve been sticking to our brand values. We’ve also tried to open our doors to UK banks and explain our processes, as well as trying to understand their potential concerns. UK banks are very influential globally and when they start onboarding cryptocurrency companies this will have a significant positive effect. I’m very confident it’s a question of when, not if this will occur.

“Cryptocurrencies’ arrival is more disruptive than the invention of the internet.”

New Money Review: Under what circumstances do you reveal a client’s identity to a third party?

Obi Nwosu: We do in a very limited number of circumstances. Firstly, we run electronic verification checks on all new applicants. Secondly, for legal reasons: for example, if law enforcement provides us with court orders regarding a particular person.

New Money Review: In the US, the Inland Revenue Service has requested that Coinbase turn over client account information. The exchange has recently told around 13,000 of its clients that it is doing so. Is this possible in the UK?

Obi Nwosu: Not under current rules, as far as I’m aware. In the UK, the authorities have to say they’re investigating a particular person and then provide the necessary documentation to obtain that person’s client account information.

New Money Review: The recent acquisition of cryptocurrency exchange Poloniex by Circle, reportedly for $400 million, caught many people’s attention. What are your and your fellow shareholders’ plans—could a similar deal be on the cards?

Obi Nwosu: If we had the opportunity to continue to run this company and be involved in this industry for the long term, I’d be delighted. It’s a privilege to be able to run an exchange, which is a centre of the cryptocurrency community. It’s incredibly enjoyable and we have an amazing team. Having said that, if a compelling opportunity came along, we’d be obliged to offer it to the shareholders to discuss.

New Money Review: How would you describe your longer-term business plans?

Obi Nwosu: We’d like to double down on our focus on servicing institutions and sophisticated retail clients. There aren’t many exchanges out there that have such an institutional focus and we have a number of propositions we’d like to develop for such clients. That focus also means we have a conservative and quite detailed process for onboarding clients. We are steadily increasing the number of questions we ask of potential new clients.

New Money Review: Settlement on the bitcoin blockchain is determined by probability—by convention, you have to wait for six blocks to be printed, or about an hour in time, before a transaction is considered irreversible. How does this affect the ability of high-frequency traders and arbitrageurs to trade in the currency?

Obi Nwosu: It does affect the ability of arbitrageurs to move money around. Other things being equal, they have to keep larger balances on each exchange than they would otherwise do, as the time they need to wait for confirmations reduces their velocity of trading.

“Cryptocurrencies are best understood as the fuel to power a decentralised economy.”

But there are discrepancies in the way different exchanges handle confirmations. Some wait several blocks before issuing a trade confirmation—the most conservative stance, since it’s considered infeasible to roll back the blockchain after six or more blocks have been printed—while other exchanges may be prepared to issue a confirmation immediately or after one block. That’s riskier both from the perspective of the exchange and its clients, since the risk of a hack via a double spend is higher.

Waiting six blocks to consider settlement as final is probably excessive these days, given the very substantial processing power that’s now behind the bitcoin blockchain. But at Coinfloor we are on the conservative side when issuing confirmations, and clients have to wait a few blocks for that to take place.

New Money Review: How big do you think the cryptocurrency market will become?

Obi Nwosu: In some ways, cryptocurrencies’ arrival is more disruptive than the invention of the internet. The amount of change I expect in the next five to ten years is going to be incredible.

The biggest impediments to things changing are not technical: they are social and are a result of humans’ slow adjustment to thinking in terms of cryptocurrencies. When they do, it’s going to be incredibly impactful.

“How widely used cryptocurrencies become is not necessarily a price forecast.”

I’d like to stress that how widely used cryptocurrencies become is not necessarily a price forecast for individual currencies. I don’t want to make price forecasts. But as a payment system, we may be able to crack the scaling, usability and performance issues of cryptocurrencies so that you only need a small amount of any cryptocurrency to transfer value.

So under the most optimistic scenario—cryptocurrencies being used for all internet commerce—you may still not have to have a high final price for the currency units themselves, since the velocity will be so high. You could have a low price per coin, but a very high volume and value of transactions.

For those involved in mining coins, or in verifying transactions under a proof-of-stake system, you could then end up earning a lot from transaction-based fees. And the outlook for the exchange business, since people will need to convert from one crypto to another, or to and from fiat, is therefore also healthy.

Cryptocurrencies are best understood as the fuel to power a decentralised economy. Ultimately, decentralised computation and decentralised organisations are going to be the final form of the internet.