Launched at the peak of the 2017 bubble, regulated bitcoin futures are playing an increasingly important role in the market for the decade-old cryptocurrency.

Futures volumes rise

The launch of bitcoin futures trading by the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) helped signal the end of the last major bull market.

On December 17, 2017, the day on which trading in bitcoin futures started on the CME, a single bitcoin reached a record $19,783.

But the ensuing bear market, which appears to have bottomed early this year, has brought contrasting reactions from the two major derivatives exchanges.

The CBOE announced in March 2019 that it would no longer offer bitcoin futures trading. Before their withdrawal, the CBOE’s futures contracts had consistently recorded less than half the trading volume seen on the CME, its competitor exchange.

“Participation is growing every day”

But the CME’s decision to stick it out appears to be vindicated by a recent improvement in trading activity, helped by the 2019 recovery in the bitcoin price.

On 13 May this year, a day on which bitcoin’s price rose by more than 10 percent against the US dollar, the CME recorded a record trading day of 33,677 bitcoin futures contracts (equivalent to 168,385 bitcoin or $1.3bn).

To put things in perspective, that daily record was 32 times more than the average daily volume during the first month of the CME bitcoin contract’s existence.

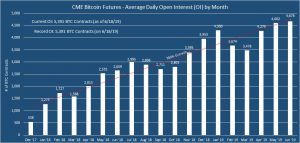

Meanwhile, the average daily open interest in bitcoin futures also hit a new record this week, the CME told New Money Review.

At 5,391 contracts on June 18 (equivalent to 26,955 bitcoin or $244m as at that day’s conversion rate), this was over ten times higher than the average daily open interest of December 2017.

“We’re pleased that participation is growing every day, and we’re seeing trading across customer segments,” said Tim McCourt, global head of equity index and alternative investment products at CME.

Other futures trading platforms have also seen strong recent volume rises.

CryptoFacilities, a peer-to-peer futures trading platform acquired earlier this year by cryptocurrency exchange Kraken in a nine-figure US dollar deal, told New Money Review that it had seen record trading volumes in bitcoin futures of $2.6bn in May.

May’s trading volumes exceeded the average monthly turnover for last year by more than 600 percent, CryptoFacilities said.

CME bitcoin futures open interest

Futures now drive spot prices

Futures are also playing an increasingly important role in setting prices for the whole bitcoin market, says Carol Alexander, a professor of finance at the University of Sussex.

Alexander says she has found statistical evidence that trading in futures now drives changes in bitcoin’s price for immediate settlement (or ‘spot price’).

“Futures are playing a leading role”

Alexander told attendees at last week’s Cryptocompare Digital Asset Summit that she had examined two particularly volatile recent bitcoin trading days, each involving price swings of more than ten percent against the dollar.

An analysis of exchange data suggests that traders are turning increasingly to futures as their instrument of choice, she said.

“There’s statistical evidence that futures are playing a leading role in determining the bitcoin spot price,” Alexander said.

Arbitrage opportunities erode

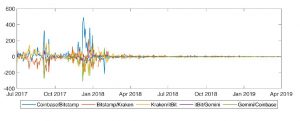

Meanwhile, the days of chaotic pricing differentials across global bitcoin exchanges seem to be disappearing.

Famously, the cryptocurrency witnessed the ‘Kimchi premium’ in December 2017, when the dollar price of bitcoin on South Korean exchanges exceeded the price in the rest of the world by more than 50 percent.

Now, however, there is little difference between the spot bitcoin exchange rates on the cryptocurrency exchanges that contribute pricing data to the regulated futures market, said the University of Sussex’s Carol Alexander.

“Profits from arbitrage strategies have more or less gone”

Four exchanges—Coinbase, Bitstamp, Kraken and itBit—provide the price data for the Bitcoin Reference Rate (BRR) that underlies the CME’s futures contract, while the now-defunct CBOE futures contract used US cryptocurrency exchange Gemini as its price source.

“It really doesn’t matter which bitcoin exchange rate you’re using, as long as it’s from one of the better exchanges,” said Alexander.

“Profits from standard arbitrage strategies, unless you’re doing very high frequency trades, have more or less gone,” she said.

Daily average spreads between bitcoin exchanges (in basis points)

Institutional interest and structural impediments

When compared to the 2017 bull market in cryptocurrency prices, which featured lots of retail participation, the recent market recovery has had a much more institutional flavour, says Christopher Matta, co-founder of New Jersey-based Crescent Crypto Asset Management.

“In 2017 your cab driver was probably talking to you about bitcoin,” said Matta, speaking at the recent Cryptocompare Digital Asset Summit.

“But blockchain data tells us that the proportion of holders of between 1 and 10,000 bitcoin ($9,300 to $93m), measured relative to all holders of bitcoin, has gone up drastically. Of the last million bitcoins that have been minted, half have gone into wallets in that size bracket,” said Matta.

“This gives a sense that a lot of the accumulation that’s going on is at the larger, institutional level,” he concluded.

But European institutions are proving slower to invest in cryptocurrencies, said Sui Chung, head of cryptocurrency pricing products at CryptoFacilities.

“I would like to see more clearing and prime brokerage”

“The US market has a wider range of institutions and more pioneering behaviour,” said Chung. “In Europe, institutional asset pools are larger and probably more conservative.”

Some important attributes of the traditional financial markets are still missing when it comes to cryptocurrency, says Alexi Esmail-Yakas, head of product at Elwood Asset Management.

“We are interested in products that enable us to have a more balance sheet efficient way of getting exposure, whether that’s futures or swaps,” said Esmail-Yakas.

“In the traditional futures markets, one of the big drivers of increasing trading volumes was the ability to clear exposures centrally. I would like to see more clearing and prime brokerage in cryptocurrency futures. I could then trade on two venues and my risk on both could be netted off,” said Esmail-Yakas.

While the CME follows the traditional clearing model for its bitcoin futures trading, where a central counterparty guarantees the performance of all trades, unregulated cryptocurrency derivatives platforms follow their own risk management procedures, sometimes involving the explicit socialisation of losses among exchange users.

Sign up here for New Money Review’s monthly content updates